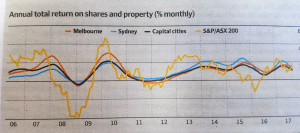

One of the things often discussed by clients is “what is best shares or property” with the Melbourne and Sydney property markets jumping ahead in leaps and bounds lately most peoples minds jump straight to property but lets look at some numbers.

Last week the Australian stock exchange (ASX) benchmark ASX 200 closed above 6000 points for the first time in close to ten years (basically since the global financial crisis) so the Australian stock market is also doing very well lately with are stable economic conditions of the last few years. If you have a look at the chart above you can see the true story of shares vs property.

- Shares are more volatile ie lower lows and higher highs and overall more of them

- Shares and property do pretty much match each other

- The return on shares is starting to beat residential property despite the property booms

There are other differences between shares and property that are important;

- It is economically viable to buy shares with as little as $5000 where a property will normally set you back at least $300,000-$400,000 if not more.

- Transaction costs are high to buy property, you need to pay lawyers, real estate agents and stamp duty

- You are able to borrow more against property than shares

- Property generates rent while most shares generate dividends, both having different timing and taxation consequences.

Overall property and shares have different features and can suit different people or the same people but at difference stages of life or for different purposes. If you have any questions about this please feel free to get in contact and do please get financial advice before making any investment decision.

*Graph source The Financial Review November 11 2017